The imbalance between rental supply and demand is causing rents to surge at their fastest pace since 2008, according to a new report.

CoreLogic’s Quarterly Rental Review revealed that the national rental rates are up 8.9 per cent compared to the same period last year, the highest annual growth the country’s rental market has seen since the Global Financial Crisis.

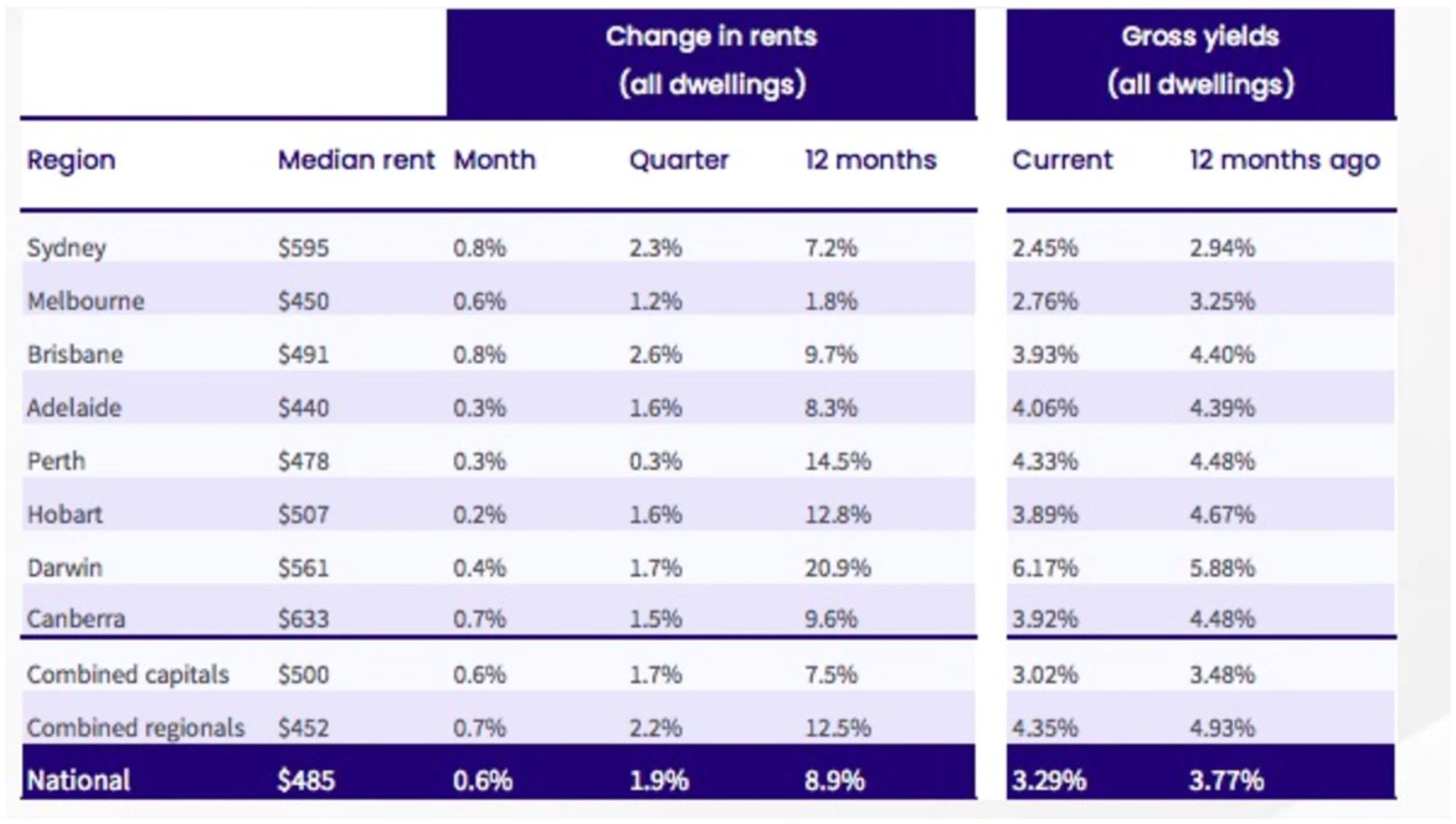

On a quarterly basis, the national rental index increased 1.9 per cent during the September quarter, easing from a 2.1 per cent rise in the June quarter.

CoreLogic’s research director Tim Lawless said the country’s rental growth is being driven by several factors, including a heightened demand for detached housing and a lack of supply due to historically low levels of investor activity.

“Renters are clearly looking for lower density housing options, with house rents rising at more than double the pace of units rents over the past year; however, this trend is starting to narrow, with national house and unit rents rising at the same rate over the September quarter (1.9 per cent),” Mr Lawless said.

He added that the rising popularity of the work-from-home setup is boosting demand for rental properties.

“Another factor that may be contributing to rental demand is that more renters are working from home, which could be driving a trend towards smaller rental households as tenants look to maximise their space and working environment during COVID.”

Commenting on the figures, Mr Lawless said that while rental growth has eased quarter on quarter, he expects rent to further increase in the foreseeable future.

However, he warned that as incomes fail to rise at the same pace as rents, affordability will eventually become an issue.

“Data to March shows renters were spending an average of 28.7 per cent of their household income on rental payments, which is slightly above the decade average of 28.1 per cent,” he said.

“Rental affordability has deteriorated further from there, which is likely to see more renters looking towards higher density rental options where renting tends to be more affordable.”

Regional rental markets outpace capital cities’ growth

Regional rental markets recorded a faster pace of growth during the September quarter, increasing 2.2 per cent compared to capital city dwelling rents, which increased 1.7 per cent over the same period.

Regional markets had the highest annual rental growth rate ever recorded since CoreLogic began measuring rental indexes in 2005, at 12.5 per cent as of this September.

Comparatively, the combined capital cities posted annual rent growth of 7.5 per cent – the biggest increase for the combined capitals since January 2009.

Mr Lawless cautioned that regional renters were feeling the sting of demand which was driving up prices.

“Demographic data is showing a clear trend towards regional population growth, driven by a combination of more people leaving cities for the regions, but also fewer people moving from the regional areas to the capitals,” he said.

“With regional housing rents rising 12.5 per cent over the past year at a time when household incomes have hardly budged, it’s likely that rental affordability is becoming a lot more challenging in some of the most popular regional markets.”

Brisbane, Sydney landlords see solid growth

With the exception of Melbourne’s unit market, all capital cities recorded an increase in rental values (both in house and unit markets) over both the latest quarter and over the year, according to CoreLogic.

Notably, it’s a good time to be a landlord in Brisbane, as the Sunshine State recorded the strongest rental growth over the September quarter, rising by 2.6 per cent. This was followed by Sydney, which saw a quarterly rental growth of 2.3 per cent.

On the other end of the spectrum, Perth recorded the weakest growth in rents over the latest quarter, as combined rental values rose by only 0.3 per cent.

Adelaide continues to be the cheapest capital city for rentals, with average dwelling rents of $440 per week.

The figures are a stark difference to Canberra, which is the most expensive place to rent in the country, with a median weekly rent of $633.

Change in weekly rents, gross yields for September quarter. Source: CoreLogic

Gross rental yields compress further as dwelling values rise

Despite solid growth in rents in the three months to September, national rental yields compressed to 3.29 per cent as dwelling values rose by a staggering 4.8 per cent during the same period, CoreLogic revealed.

Over the last 12 months, national gross rental yields have fallen 48 basis points from 3.77 per cent. With the exception of Darwin, gross rental yields were lower across all capital cities over the quarter.

Darwin has the country’s highest gross rental yield at 6.17 per cent. This is followed by Perth (4.33 per cent), Adelaide (4.06 per cent ), Brisbane (3.93 per cent ), Canberra (3.92 per cent ), and Hobart (3.89 per cent ).

The two biggest Australian capital cities lagged behind the pack, with Sydney and Melbourne’s gross rental yields at 2.4 per cent and 2.76 per cent, respectively.

You are not authorised to post comments.

Comments will undergo moderation before they get published.