The focus for the cause of overinflated house prices should not be centred on negative gearing, which is merely a side issue, says a leading economist.

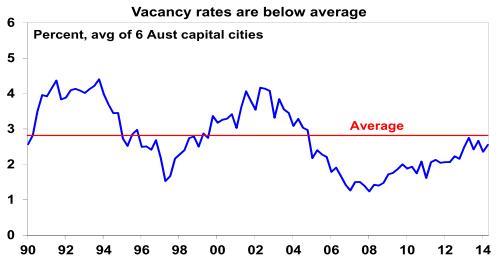

In a recent report, AMP Capital chief economist Dr Shane Oliver said the two main drivers for soaring house prices are the shift to low interest rates and a lack of supply, with low residential vacancy rates reflecting this (see graph below).

“Given the supply shortfall, most of the scapegoats that various commentators have come up with to explain high house prices are a sideshow,” Dr Oliver said.

“Foreign and SMSF buying is no doubt playing a role in some areas but looks to be small.

“Negative gearing is more contentious, but it’s likely curtailing access to it when stamp duty remains high will have a negative impact on the supply of property, to the extent it will have the effect of reducing the after-tax return to property investment,” he added.

Dr Oliver said restricting negative gearing for property would also distort the investment market because it would still be available for other investments.

His report was released after the Reserve Bank of Australia’s (RBA) Financial Stability Review came out on Wednesday last week.

“The heat in the homebuyer market is clearly starting to concern the RBA, with its Financial Stability Review indicating it’s becoming concerned about speculative activity in the property market and the risks this poses to the broader economy when the property cycle eventually turns down,” he noted.

“The best approach is for the RBA to first ramp up its efforts to warn first home buyers of the need to be cautious.

“But if that fails in quickly cooling the property market, expect an announcement from APRA and the RBA on lending restrictions likely to target investors in the next few months,” he added.

Source: REIA/AMP Capital

You are not authorised to post comments.

Comments will undergo moderation before they get published.