The past decade has offered a mixed result for real estate, but new research has pinpointed the suburb that offered the best return.

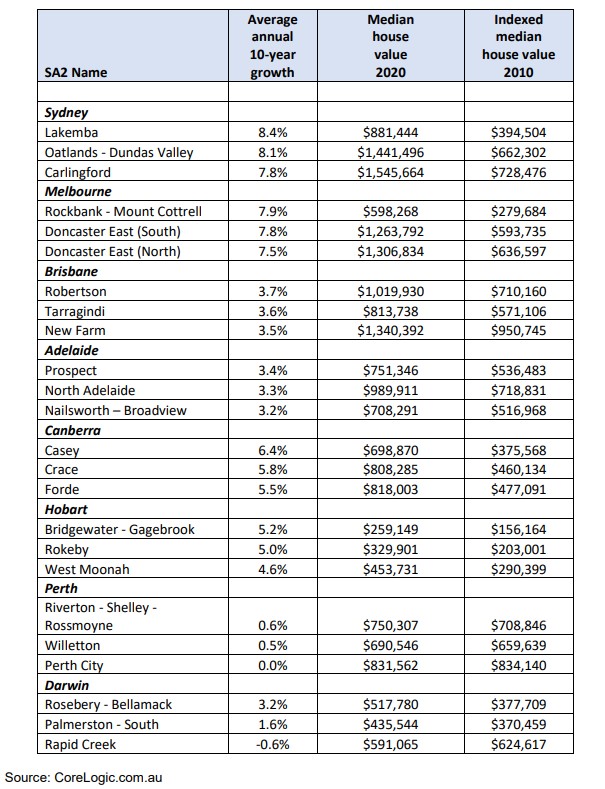

Joint research from CoreLogic and the Property Investment Professionals of Australia (PIPA) identified Lakemba in Sydney to have the country’s highest annual capital growth over the past decade.

House prices in the Canterbury region suburb increased by 8.4 per cent annually, and median house values more than doubled over the last 10 years to $881,000.

Home owners in the Oatlands-Dundas Valley region also said their property values grew, with an average annual increase of 8.1 per cent, which has seen the median house prices grow to $1.41 million in the Sydney suburb.

Melbourne’s Rockbank-Mount Cottrell area came in third, with an annual return of 7.9 per cent growth, and the average home price is nearly $600,000.

The research revealed growth in prestigious and affordable suburbs, and areas deemed subdued continued to record robust house value growth, PIPA chairman Peter Koulizos said.

“Even though Adelaide only recorded average annual growth of 1.3 per cent over the past decade, its top-performing location of Prospect saw prices increase by 3.4 per cent per year over the period,” Mr Koulizos said.

“Likewise, in Darwin, where prices reduced on average 1.9 per cent annually, in Rosebery-Bellamack median house values increased by 3.2 per cent at the same time.

“This is actually quite common because there are submarkets within markets which operate to the beat of their own drums, usually because of consistently strong demand from buyers keen to live or invest in those locations.”

Sydney recorded the highest average annual capital growth at 5.5 per cent over the last decade, followed by Melbourne at 4.9 per cent and Hobart at 3.4 per cent.

The worst performers were Darwin at -1.9 per cent and Perth at -1.4 per cent.

“Investing in the housing market is typically a long-term strategy. Short-term movements are less important than the longer-term trends, which typically see housing values moving through a cycle where values will rise, fall and track sideways,” CoreLogic head of research Tim Lawless said.

“The past 10 years has seen areas of Sydney and Melbourne outperform most other markets thanks to strong economic conditions and high rates of migration, which has fuelled housing demand; however, such high rates of capital gain have eroded housing affordability and compressed rental yields.”

Over the next 10 years, it is likely the top-performing markets will be quite different, Mr Lawless said.

“Just as they were over the earlier decade where, for example, mining regions and regional coastal markets were some of the strongest performing areas.”

You are not authorised to post comments.

Comments will undergo moderation before they get published.