Investors who like a glass of wine and want to make a return could be in luck as wine regions have been earmarked as top performers.

Regional areas across Australia have done well in recent years, and investors who put their money in some areas outside capital cities have been rewarded, Propertyology head of research Simon Pressley said.

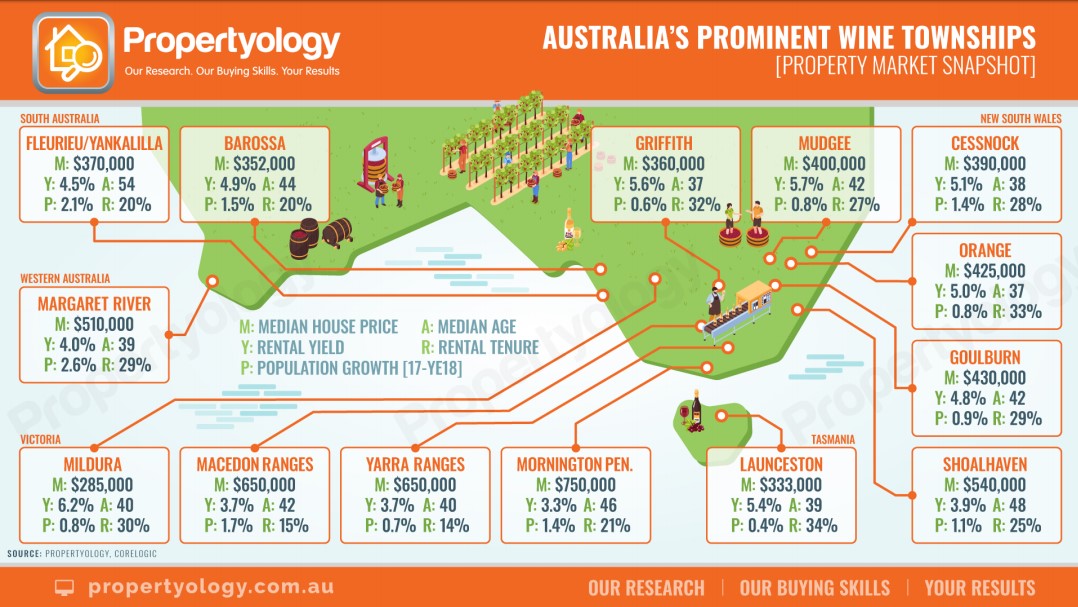

New research from Propertyology has crunched the numbers and identified 14 wine-producing regions that are set to continue outperforming the Sydney market.

“Over the last 20 years, the 6.9 per cent average annual rate of capital growth for a Sydney house was inferior to the municipalities of Cessnock, Goulburn, Launceston, Macedon Ranges, Mornington Peninsulas, Mudgee, Shoalhaven, Yankalilla and Yarra Ranges. The 6.4 per cent average annual capital growth for Orange is similarly impressive,” Mr Pressley said.

“The property markets of these wine regions are also significantly less volatile than Sydney. While Sydney produced five calendar years of median house price declines during the last two decades, 12 out of these 14 wine regions saw price declines in only one to four years.”

He noted the numbers in regional areas have been strong in recent years compared to capital cities.

Residential properties in regional areas such as Orange, Cessnock, Launceston, Macedon Ranges and Mornington Peninsula all saw growth of 20 per cent or more, he said.

“Conversely, seven out of Australia’s eight capital cities were well below 20 per cent over the three years ending 2019. Hobart’s 30 per cent growth was streets ahead of second place — Canberra at 14.7 per cent — while the cumulative growth across the three years in Adelaide, Brisbane and Sydney was in single figures, and Perth and Darwin property prices declined.”

The demand from tenants has remained steady in these regions as well. Figures from December 2019 showed the vacancy rate in these 14 areas was below 3 per cent.

The economies in these regions also attract and retain a diverse range of residents who need accommodation.

“The economy in most of these communities blends general agriculture with viticulture, manufacturing (especially food-related), and some amazing tourism experiences,” Mr Pressley said.

“The demographics of these vibrant vino wonders include a mix of multigenerational farmers, some affluent white-collar professionals who have elected to escape stressful city life, creative artistic types, and some retired Baby Boomers who can finally rid themselves of the rat race.”

You are not authorised to post comments.

Comments will undergo moderation before they get published.