How much are property management professionals paid? What is their preferred remuneration structure? What are their main causes of discontent? Real Estate Business reveals all in this exclusive report.

Principals take note: property management professionals believe they’re overworked and underpaid.

That was the most striking conclusion from the Australian Residential Property Management Industry Remuneration Survey 2015, which attracted 760 respondents from around Australia.

According to the survey, most respondents earn less than $55,000, with 60.4 per cent earning no more than the year before and only 43.3 per cent expecting to receive a raise in the year ahead.

Another interesting finding was that most professionals don’t receive a regular salary review.

The survey identified a possible link between the industry’s salary levels and its educational levels. Only 10.4 per cent of respondents had completed a university degree, which compares to 21.2 per cent for the general population, according to the most recent Australian Bureau of Statistics (ABS) data of May 2014.

Obviously, a university degree may not be required to perform a property management role – but when someone has a degree, money appears to follow.

Industry shares intimate salary details

Many principals may beg to differ, but property management professionals might have a point when they complain about being underpaid.

The survey found that 89.1 per cent of respondents earn less than $75,000 per year, while the average annual earnings for Australians with a full-time job is $80,049, according to the ABS.

However, saying that most industry employees feel they don’t earn enough only tells half the story. For many, the issue is not so much that their pay packets are too small, but that the level of responsibility they’re expected to bear in return is too large.

How much are PM professionals paid?

Three-quarters of respondents receive a base salary no higher than $65,000:

- Less than $25,000 = 1.6 per cent

- $25,001 to $35,000 = 4.0 per cent

- $35,001 to $45,000 = 22.6 per cent

- $45,001 to $55,000 = 28.2 per cent

- $55,001 to $65,000 = 20.1 per cent

- $65,001 to $75,000 = 12.6 per cent

- $75,001 to $100,000 = 8.6 per cent

- More than $100,000 = 2.3 per cent

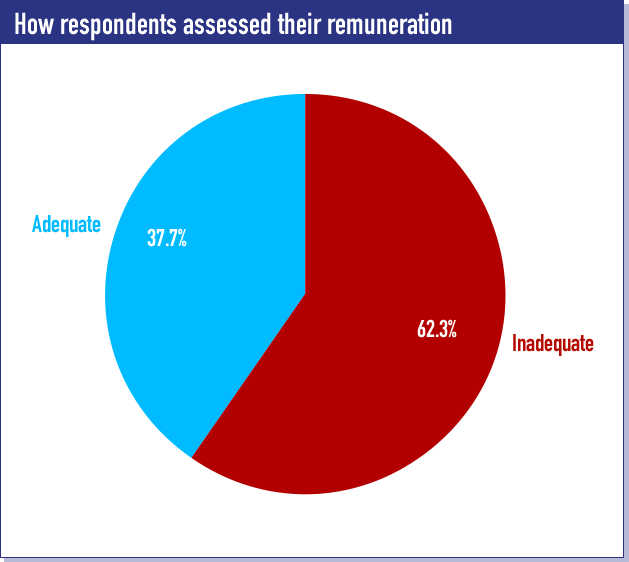

Widespread discontent over pay

Bosses demanding too much for too little

The main reason those 62.3 per cent feel underpaid:

- Responsibilities exceed their pay grade = 37.3 per cent

- Excessive workload = 21.6 per cent

- Other people in a similar role get paid more = 18.2 per cent

- Work too many hours = 9.0 per cent

- Remuneration doesn’t match their company tenure = 5.2 per cent

- Racial or gender discrimination = 1.0 per cent

- Other = 7.7 per cent

No raise for all that work

Total pay compared to the year before the survey:

- Minimal or no change = 49.2 per cent

- Higher pay = 39.6 per cent

- Lower pay = 11.2 per cent

Better times might be coming

Respondents’ salary expectations (assuming no promotion):

- Base salary likely to increase = 43.3 per cent

- Base salary unlikely to increase = 35.7 per cent

- Unsure = 21.0 per cent

How optimistic are those optimists?

The base salary increase those 43.3 per cent expect (assuming no promotion):

- 3 per cent or less = 25.4 per cent

- 4-5 per cent = 34.2 per cent

- 6-10 per cent = 20.9 per cent

- 11 per cent or more = 3.1 per cent

- Unsure = 16.4 per cent

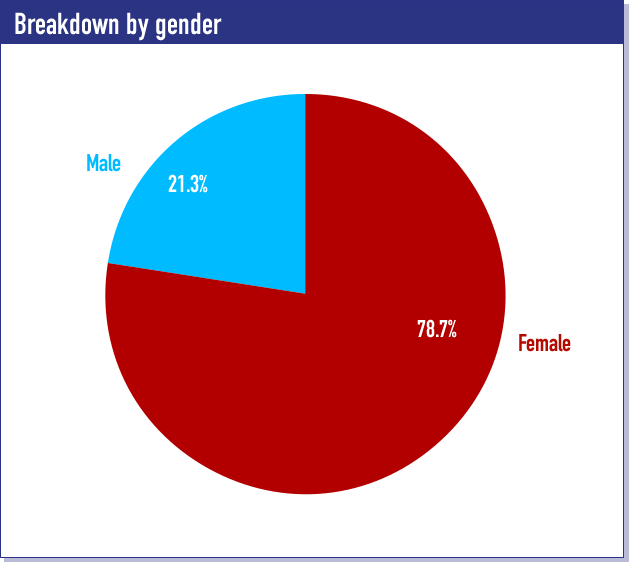

No industry for old men

One common view of the property management industry is that it’s dominated by younger women. But is this confirmed by the survey?

Largely, but not entirely, it turns out. The gender part is certainly true – there are about four women to each man. The picture on age, though, is more nuanced. Although about five in 10 property management professionals are aged between 21 and 39, about four in 10 are aged between 40 and 49.

Another interesting finding was that significant numbers of professionals are still accumulating experience in the industry and tenure at their company. That might partly explain why most property management staff earn less than the average Australian.

It also suggests that the industry provides excellent career opportunities for younger Australians, at a time when youth unemployment is nearing record levels.

Female-dominated profession

TAFE qualifications significantly outnumber university degrees

Respondents’ highest form of education:

- Didn’t finish high school = 5.5 per cent

- Finished high school = 28.2 per cent

- TAFE certificate = 21.7 per cent

- TAFE diploma = 23.4 per cent

- Some university = 10.8 per cent

- University undergraduate degree = 8.0 per cent

- University postgraduate degree = 2.4 per cent

Younger rather than older

Breakdown by age:

- 17 or younger = 0.3 per cent

- 18-20 = 1.3 per cent

- 21-29 = 26.8 per cent

- 30-39 = 24.0 per cent

- 40-49 = 21.5 per cent

- 50-59 = 18.8 per cent

- 60 or older = 7.3 per cent

Less experienced rather than more experienced

Level of industry experience:

- Less than 1 year = 3.2 per cent

- 1-3 years = 18.9 per cent

- 4-5 years = 14.2 per cent

- 6-10 years = 25.8 per cent

- 11-15 years = 18.0 per cent

- 16 or more years = 19.9 per cent

Industry professionals still building seniority

Time with current employer:

- Less than 1 year = 15.3 per cent

- 1-3 years = 41.0 per cent

- 4-5 years = 18.1 per cent

- 6-10 years = 14.4 per cent

- 11-15 years = 8.1 per cent

- 16 or more years = 3.1 per cent

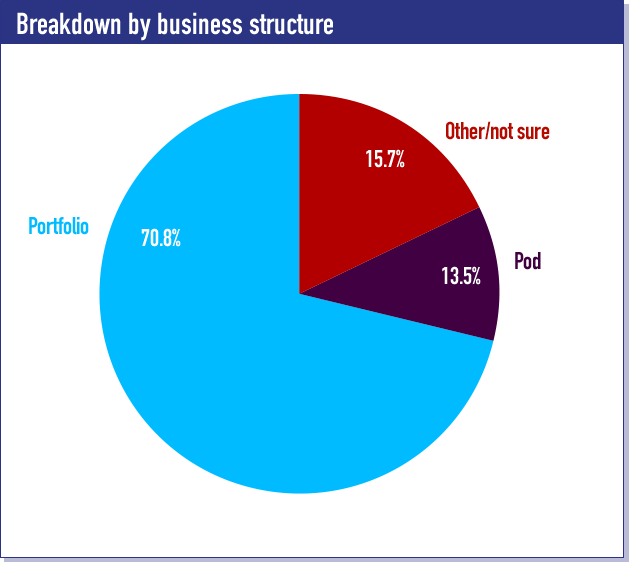

PM businesses are small and nimble

Thanks to the Australian Residential Property Management Industry Remuneration Survey 2015, a picture of the average property management office has emerged.

The typical office is part of a multi-service agency rather than a specialist PM business. It operates a portfolio structure, with each person managing between 101 and 200 properties.

Half of these businesses have no more than five property management staff, and 80 per cent have a maximum of 10 staff. Property managers abound, but BDMs are few and far between.

Independent v franchise

Breakdown by sector:

- Independent = 48.3 per cent

- Franchise = 47.1 per cent

- Cooperative = 4.6 per cent

Pod v portfolio

All-rounders not specialists

The type of agencies that respondents work for:

- Multi-service agency = 89.9 per cent

- Property management only = 10.1 per cent

Industry dominated by smaller teams

The amount of property management staff that agencies employ:

- 1-3 = 27.5 per cent

- 4-5 = 22.2 per cent

- 6-10 = 29.4 per cent

- 11-15 = 10.0 per cent

- 16-25 = 7.0 per cent

- 25-50 = 3.2 per cent

- 51 or more = 0.7 per cent

Nine property managers for every one BDM

The primary roles of property management staff:

- Property manager = 54.1 per cent

- Head of property management = 22.9 per cent

- BDM = 6.2 per cent

- Principal/owner = 4.5 per cent

- Assistant property manager = 3.5 per cent

- Admin/reception = 1.5 per cent

- Property officer = 1.1 per cent

- Other = 6.2 per cent

Property managers given significant workloads

Number of properties being managed by PMs:

- 0-50 = 5.9 per cent

- 51-100 = 19.2 per cent

- 101-200 = 51.3 per cent

- 201-300 = 15.4 per cent

- 301-400 = 3.2 per cent

- 401-500 = 2.0 per cent

- 501 or more = 3.0 per cent

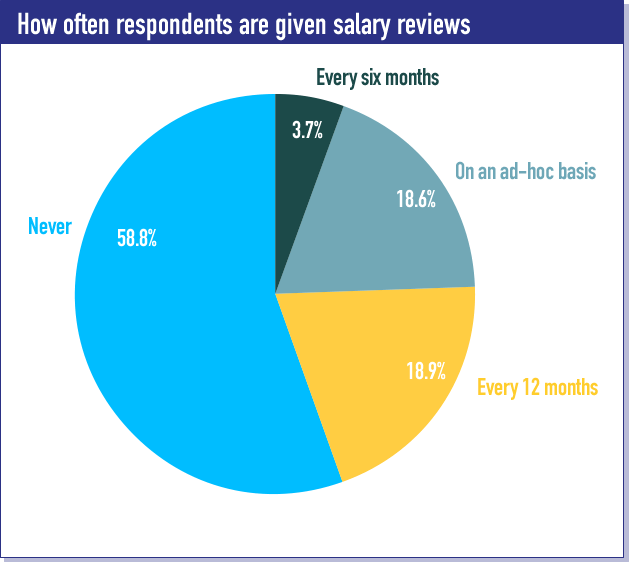

Property management professionals give their verdict

On a scale of one to 10, based on their total remuneration, how likely is it that survey respondents would recommend their company to a friend or colleague?

Before the answer is revealed, it’s worth considering what would influence their answer. Some of the factors have already been discussed – salary levels, workload, age and industry experience.

The remainder of the survey explores the other factors, which include salary reviews, remuneration structures and financial incentives.

One area of possible discontent is a lack of structure around the salary review process. Most respondents hadn’t had a salary review, and only just over 20 per cent had a meeting planned in the next 12 months.

But the survey findings suggest money wasn’t the sole motivator for property management staff. For those principals hamstrung by tight budgets – not uncommon for many small businesses in Australia – one popular non-financial incentive was offering flexible working hours.

Most industry professionals don’t receive salary reviews

But most staff are offered financial incentives

Respondents who can claim bonuses and commissions:

- Eligible = 65.4 per cent

- Ineligible = 34.6 per cent

Salary still provides vast majority of income

Share of gross income provided by bonuses and commissions:

- 0-5 per cent = 58.0 per cent of respondents

- 6-10 per cent = 22.9 per cent

- 11-20 per cent = 9.9 per cent

- 21-30 per cent = 5.0 per cent

- 31-40 per cent = 2.8 per cent

- 41-50 per cent = 0.9 per cent

- 51 per cent or more = 0.5 per cent

Incentive payments are good, but financial security is better

How property management professionals would like to be remunerated:

- Base salary plus financial incentives = 69.9 per cent

- Base salary only = 26.6 per cent

- Financial incentives only = 0.5 per cent

- Other = 3.0 per cent

Non-financial incentives are also attractive

Industry professionals nominate their top three non-financial incentives:

- Flexible hours = 57.5 per cent

- Extra annual leave = 53.8 per cent

- Training = 33.5 per cent

- Awards = 28.3 per cent

- Other = 7.4 per cent

Bosses told to do better on pay

Industry professionals rank their companies based on their total remuneration. The overall score came in at 6.14:

- 0 out of 10 = 5.7 per cent

- 1 out of 10 = 3.2 per cent

- 2 out of 10 = 5.0 per cent

- 3 out of 10 = 4.7 per cent

- 4 out of 10 = 4.7 per cent

- 5 out of 10 = 13.9 per cent

- 6 out of 10 = 11.2 per cent

- 7 out of 10 = 14.9 per cent

- 8 out of 10 = 16.9 per cent

- 9 out of 10 = 6.4 per cent

- 10 out of 10 =13.4 per cent

You are not authorised to post comments.

Comments will undergo moderation before they get published.