Before your client walks away from purchasing an investment property, make sure to crunch the numbers for them correctly. That next bargain may actually be affordable for a property investor if depreciation is claimed.

Real Estate Agents usually encourage their clients to consider the potential rental return of the property, the property’s location in proximity to local services and facilities, local employment drivers and historical growth of properties within the area. However, they don’t always work out the tax deductible costs and explain the deductions involved in owning the property to the investor.

Costs such as property management fees, rates, interest, repairs, maintenance and property depreciation add to an investor’s net cash return and every deductible dollar comes back to the owner at their marginal tax rate.

The following example shows how a depreciation estimate helped one Real Estate Agent to make a potential investor aware of the additional cash flow of $4,992 they would receive in the first year of ownership alone, simply by claiming depreciation.

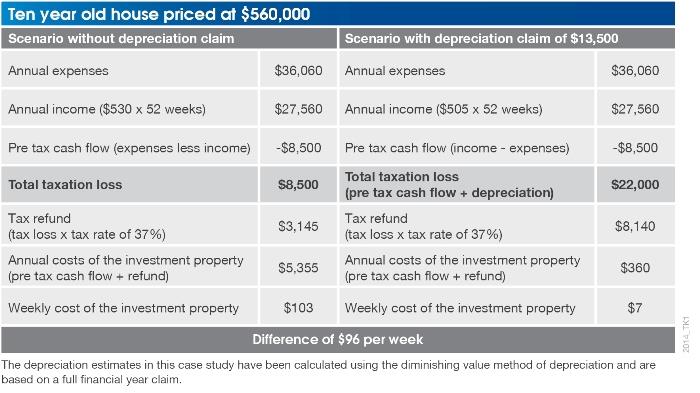

The property investor was considering purchasing a ten year old house priced at $560,000. During the investor’s inspection of the property, the Agent provided a rental appraisal which outlined an expected rental income of $530 per week, or $27,560 per year.

The Agent was also able to provide the investor with an estimate of the costs involved in owning the property. Expenses including interest rates, property management fees, rates, repairs and maintenance costs came to a total of $36,060 per annum.

The Agent contacted BMT Tax Depreciation for a free assessment of the likely depreciation deductions the investor could expect from the property and found that they would be able to claim approximately $13,500 in depreciation in the first full financial year.

The following table provides a summary of these costs and the investor’s annual position, depending on whether or not depreciation is claimed.

The depreciation estimates in this case study have been calculated using the diminishing value method of depreciation.

Without claiming depreciation, the property investor would experience a loss of $103 per week during the first year of owning the property. By claiming depreciation, the weekly cost is reduced to $7, saving them $96 per week or $4,992 in the first year of ownership.

By providing an estimate of the likely depreciation deductions to their investor client, the Real Estate Agent was able to help them to gain a better perspective of the affordability of the property and their future cash flow position.

To get a free depreciation estimate for your clients’ simply contact one of BMT Tax Depreciation’s helpful staff on 1300 728 726, or use the BMT Tax Depreciation Calculator. The calculator is available online or as an app for iPhone or Android phone.

You are not authorised to post comments.

Comments will undergo moderation before they get published.