Every Real Estate Agent or Property Manager could name at least one client who has recently purchased and rented an investment property. But how many of these investors are prepared for tax time and will claim the maximum deductions they are entitled to?

Even if a property is purchased towards the end of a financial year, a specialist Quantity Surveyor can find valuable deductions for this short period of ownership.

Investors often make the mistake of postponing getting a depreciation schedule prepared until next year. However, there are ways in which partial year deductions can be maximised, resulting in extra cash for the new owner.

A Quantity Surveyor will use legislative tools to make partial year claims more beneficial to new investment property owners regardless of how long the property has been owned and rented. Here are just a couple of the methods used:

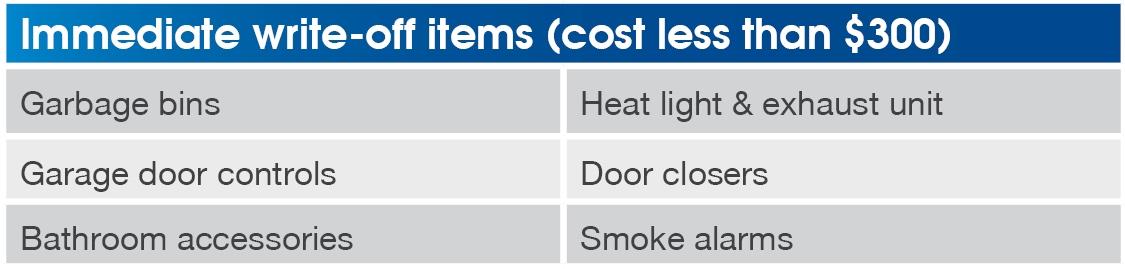

Immediate write-off

An immediate write-off can be applied to any item within an investment property which cost less than $300, regardless of how long the property has been owned and rented. Assets that would typically fit into this category include

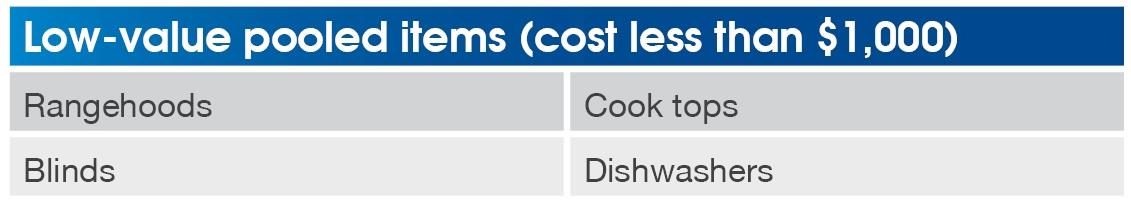

Low-value pooling

This is a method whereby depreciation of plant and equipment assets is claimed at a higher rate to maximise deductions. Low-cost assets valued less than $1,000 can be placed in a low-value pool where they can be claimed at a rate of 18.75% in the year of purchase and 37.5% for each year afterwards, regardless of how long the property has been owned and rented. Typical examples of assets that would fit into this category are available in the below table

The following example shows how BMT Tax Depreciation was able to maximise one new investment property owner's deductions for a partial year claim.

The investor purchased a house for $550,000 and rented the property on the 2nd of June. The table below outlines the deductions the owner could claim from property depreciation after only holding the property for twenty nine days.

Including the capital works and plant and equipment deductions, the owner claimed back $4,852 for the first financial year.

The plant and equipment deductions for the first twenty nine days totalled $4,082. By using the immediate write-off for items costing less than $300, BMT was able to find $1,288 for this property owner. From low-value pooled items, the owner was also able to claim back $2,274. The remaining items were depreciated based on their effective lives and scaled down based on the small portion of the first financial year. These account for the remaining $520 in deductions.

As this example shows, encouraging new investment property owners to request a tax depreciation schedule immediately on settlement can really help to boost their cash flow. Making an investor aware about depreciation can also assist in the sales process as the additional funds received from depreciation can be a huge benefit, particularly when an investor has had to outlay substantial funds to secure the purchase of the property.

If you own an investment property and haven’t had your depreciation schedule completed then now is the time to act. If you order and pay for your schedule before 30 June, you can claim the fee straight back on this year’s tax return. Request a quote today and maximise the return from your investment.

You are not authorised to post comments.

Comments will undergo moderation before they get published.